Absolute & Relative Valuation

The Left Side and Right Side of the Brain

According to rhetoric (and perhaps scientific theory?) out there, the left side of our brain is more analytical and methodical while the right side is more creative and artistic. Someone is said to be left brained or right brained when one of these traits is dominant. This can affect our decision making throughout life in a big way (“you’re over analyzing this” or “you just float on from one thing to the next without thinking”). To be fair, I’ve had both these things said to me so not sure which side of the brain is weighted more heavily for me.

Applying this lens to investing leads to some interesting results. The analytical approach is one that seems on the surface to be most apt to be a good investor. You comb through numbers, business model, competitor analysis, google trends, etc and come up with a valuation for the company.

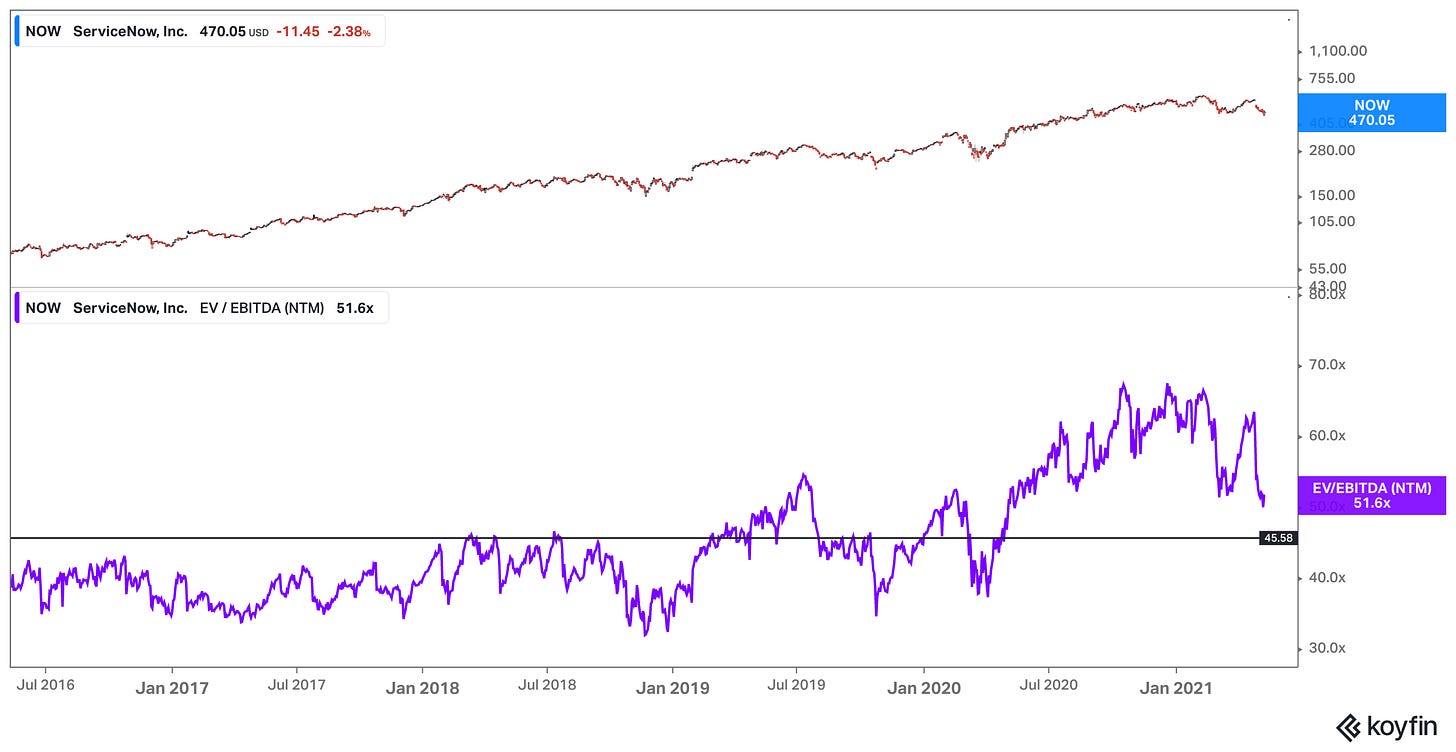

The approach to valuation in this case also is highly quantitative. What are steady state FCFs, what’s the weighted average cost of capital, what sort of internal rate of return can I expect to achieve over time. It also leads to historical analysis since numbers are always backwards looking. I find when my left brain is more heavily involved in an investment, it worries about the historical multiple the company used to trade at and where comparable companies are trading.

In effect, the left brain is leading to a focus on Relative Valuation. We are evaluating the investment based on where other companies are trading and our relative view of that company vs others.

The second approach is using more of the right brain. The creative side that looks more into culture, hiring strategy, and future product creation. The creative side tends to be more optimistic than the analytical side.

In effect, the right brain is leading to a focus on Absolute Valuation. We are evaluating the investment based on how big we think it can be in the future with assumptions on future output.

The natural question that follows is cool Shomik, so which one is more important?

Of course, my response is both (mainly just to frustrate everyone) :) .

When evaluating an investment in a company, I think we need to think both about Relative and Absolute Valuation. In some cases, a company may be cheap on a Relative basis but expensive on an Absolute basis. For me an example of this was Everbridge which was near $7B enterprise value in the past year. It was actually cheap relative to the other opportunities out there (from a comparable multiple perspective) but kind of expensive based on where I think their absolute valuation is. On the flip side, Twilio has looked quite expensive to me on a relative basis but cheap on an absolute basis, especially post Segment acquisition and Flex internal product development. BTW none of this is investment advice, do your own research, and if you listen to a newsletter called Software Snack Bites for stock tips then I don’t know what to tell you.

Try to keep this in mind next time you’re evaluating an investment. I usually practice Daniel Kahneman’s Thinking Fast and Slow framework. For me, thinking fast is usually the analytical side and thinking slow is the creative side (I’m the least artistic person in the world). So I usually do my analytical analysis first as it’s less work for me. Then I pause, take some time, and then sit around thinking through what are the qualitative factors to consider. By taking that time, it has helped me make better decisions when choosing 1) the timing of when to invest and 2) the duration for which I plan to hold that investment.

Try it next time you’re about to buy a stock!