Be Macro Aware, Micro Obsessed

Channeling our inner Bezos

They say “good artists borrow, great artists steal”. Well…we’re stealing a Jeff Bezos quote for this post and morphing it :). Bezos has said that Amazon is “competitor aware, customer obsessed”. With all the focus these days on macro, I wanted to talk about how I personally view macro when investing and what I talk about with founders when asked.

The idea for this post came as a result of some of the questions I received after last week’s post:

It’s easy to fall into the trap of being worried about macro all the time.

So let’s use an anecdote to talk about what being “Macro Aware, Micro Obsessed” means:

Let’s say you have an corner store selling umbrellas in San Francisco. Not a bad place as you get a decent amount of random rainy days that lead to spontaneous buying as well as year round rain that has people planning for rainy days ahead. So you get a steady amount of forecastable purchasing volume with random spikes where you can clear out some excess inventory. Life’s good and you’re planning for expansion into waterproof camping gear to expand your addressable market.

Then the unthinkable happens. A typical rainy Jan-March has no rainy days! As it stretches into summer months, the state government is starting to talk about a drought and water conservation. Business has slowed to a crawl. No one is purchasing umbrellas anymore. So now you’re faced with a decision, do you keep watching the weather to see when rain will return or focus on something else.

This is what being Macro Aware, Micro Obsessed is all about!

The macro is what you can’t control. The rain is not coming. Unless you have a way to trigger atmospheric pressure to magically dump water, your umbrella business is screwed as is. You can sit there studying weather patterns all day and mourning your fate or you can adjust. There are a few ways to adjust.

Positioning: The store is known as the umbrella store. Now umbrellas are normally thought of for rain however they can be used to protect against the sun, protect against the wind, be used as beach umbrellas, etc. Perhaps, you decide that you can reposition marketing & ads to talk about how umbrellas are the best way to protect your skin.

Discounting: Maybe umbrellas are your life’s work. You still have a cash flow problem where you have illiquid assets that need to be converted to cash. You can drop the price of the product to clear out inventory. You will take a loss on the assets but still have cash to redeploy into whatever is next. Only thing to consider with discounting is what did that buy you. Have you gained a loyal customer that will continue buying future products from you or was it just a one-time transaction?

Pivoting: Who likes umbrellas anyway? You decide that now is the time to focus the store on something that is not exposed to weather elements. You move to selling watches because those will sell rain or shine. You will still be exposed to macro in the future but at least not weather macro.

Cost Cutting: You’ve been selling umbrellas for 7 generations. The business has to survive. So you cut as much as possible. Staff is laid off, rent on the location is renegotiated, you tell your suppliers you’ll pay net 90, basically anything to extend runway. Maybe you find another entrepreneur who wants to start a umbrella business in Montana and start to consult with them for some revenue in the meantime. The business is staying alive for when the macro clears.

Raise More Financing: This is likely the hardest thing to do. Capital sources are not stupid and are aware there’s a drought so either they will look to take advantage of the situation (extend credit/capital for a large amount of the business) or they need to have a compelling narrative as to why the opportunity to invest now is going to lead to large returns in the future. In general, this is an area you want to avoid as much as possible until there’s a clear better story to tell.

Sell The Company: Perhaps a competitor with a stronger balance sheet sees the opportunity for 1+1=3 by combining both companies for larger market share. That market share could give leverage on suppliers, reducing input costs and improving margins. Or perhaps another company sees an opportunity to expand into umbrellas from their rain jacket clothing line. It’s always best to be doing this from a position of relative strength meaning that there are still options left for other pathways mentioned above but you are choosing to explore the M&A route proactively.

No one can control the macro. It’s a complex adaptive system based on so many different variables that it makes heads spin. What can be controlled is the micro. The inputs to the business that better position the company for the long term utilizing the context of the macro to inform decision making. Hence, why we still need to be macro aware, but only obsess over the micro.

What I enjoyed this week:

Retention is still imo the most important metric a company can look at to determine how free cash flow is trending

Great post by OnlyCFO talking about the effects of churn and how to manage it

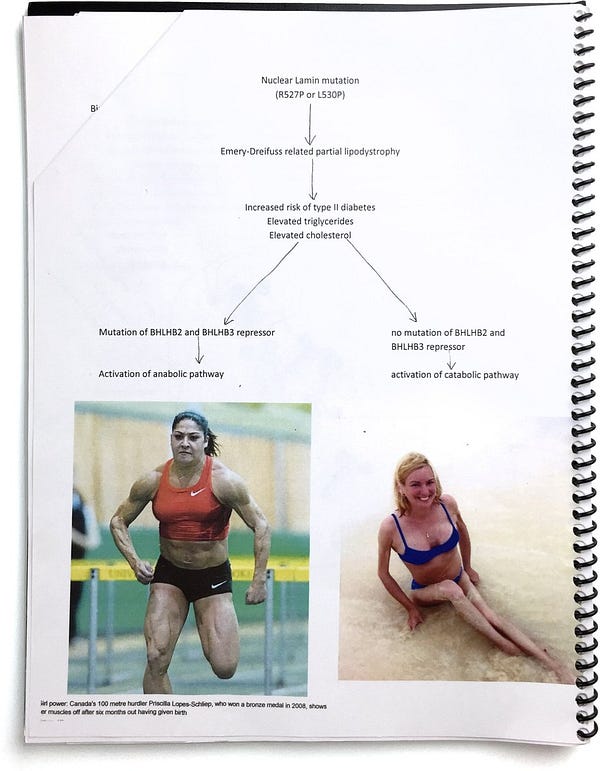

This is the most amazing story I’ve read in a long time talking about how a person with no scientific background was able to correctly diagnose two rare mutations and save the lives of two people while doing so

XPEL is a great turnaround story that has netted shareholders ~50x their money over the past 5 years (through covid, recessions, and more). This is a brief overview of how the CEO took over, turned around the business, and expanded product lines to make it the company it is today.

More vulnerabilities discovered in popular OSS libraries (dependencies nested on dependencies - i.e. software supply chain), this one in Pytorch