Constellation Software & Org Design

Thoughtful Org Design is a Significant Competitive Advantage

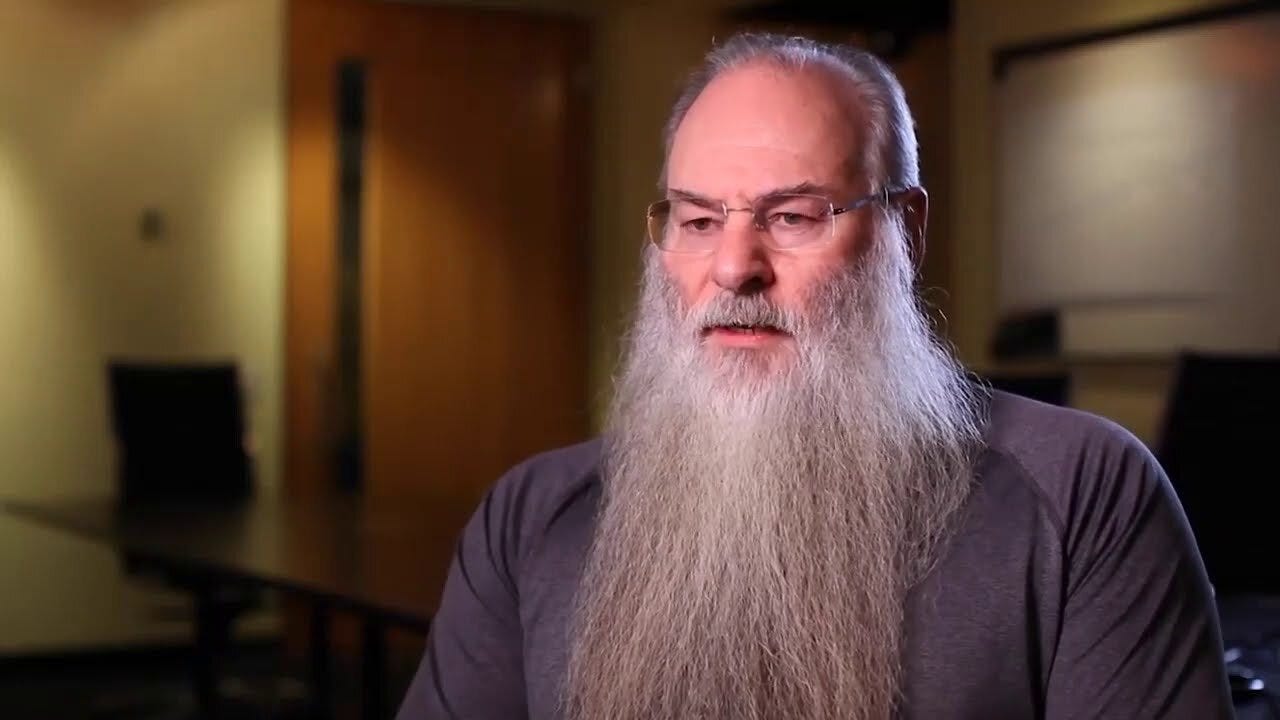

To start off this post, name who the person in this photo is.

Did you figure it out? I’m sure some of you didn’t know that he founded and runs a $40B public company called Constellation Software. The CEO is notoriously media and publicity shy. If you Google Mark Leonard’s name, you literally get two photos in images and that’s it.

Yet he is one of the most impactful investors in enterprise software.

Constellation Software is a conglomerate of vertical market software businesses. Think real estate software, travel software, boating software, and even stuff like country club software. The more niche the area, the more likely Constellation is actively looking at the company as an acquisition target.

How successful can a company be buying boating software companies? Well peep the 10-year stock chart below.

Over the past 10 years, CSU is up 35x.

Constellation was one of the few acquirers early on to understand the power of vertical market software (VMS). Although in many cases, the TAM of these companies may be smaller, the competitive dynamics are less as well which allows these companies to carve out a lucrative niche with compelling free cash flow dynamics. Constellation can then buy these businesses and utilize those free cash flow to acquire more VMS businesses repeating the cycle.

Org Design as a Competitive Moat

A lot of people ask me about Constellation’s competitive moat. Because it’s an amalgamation of various companies in various industries, the traditional barriers to entry are not as applicable here.

Instead, I believe CSU’s competitive moat is driven by org design.

As you can see from the chart above, CSU is a complex business. However, the structure of the org is very intentional. CSU has honed the craft of what decisions need to be centralized and what can be decentralized. They have structured the org to maintain flexibility and agility in their core competency, acquiring companies. This allows them to continue doing acquisitions that I believe number over 100 companies a year! (please leave a comment if you have a more accurate number but whatever the amount is, its impressive in scale and velocity)

How this works is fascinating. CSU headquarters sets targets for the “hurdle rate” that CSU needs to make from an acquisition. This sets the price and multiple that CSU is willing to pay for a target and is a metric that even the most junior person in the org can understand. Next, the Operating Groups are split up into competencies. These have blended over time as now all Operating Groups can extend into various industries. But based on existing competencies, you still see a fair amount of concentration (Jonas in fitness, Harris in utilities as an example). This allows for compounded knowledge in specific verticals while still enabling any Operating Group to acquire an attractive company that meets the hurdle rate.

The interesting thing about the Operating Groups (OG) is that they all operate independently and have their own CEOs. CSU will share best practices, hurdle rates, and can help on planning, but each OG can have their own culture. Some decide to centralize decision making more, some decide to stick with their competencies more and not expand into other verticals, etc.

Finally, there is a clear career ladder for junior employees to go from an IC that is underwriting specific acquisitions to eventually becoming a portfolio manager and beyond.

This structure allows Constellation to continue acquiring niche VMS businesses wherever they are located. Junior employees are aware of the hurdle rates and can make decisions on smaller businesses quickly without having to go through much bureaucracy. As acquisitions get larger, a few more folks may get involved but its still constrained to the operating group and usually a smaller subgroup within the broader OG. Above a certain very large threshold and also based on industry sector, HQ will get involved. All of this is spelled out clearly with a focus on long-term capital appreciation. Senior employees have to invest a certain amount of their salary into the stock and hold for a period of a few years. This incentivizes everyone to act like an owner while preserving that flexibility to act on opportunities no matter how small or large as long as the hurdle rate is hit. Any changes to compensation, incentive structures, hurdle rates, and big shifts in strategy (acquiring non VMS businesses, spinning off operating groups, etc) are all centralized at HQ.

Now some might say, CSU is facing an existential threat from Private Equity funds buying more VMS businesses and more acquirers looking in the same markets. However, none of them can replicate CSU’s org design. Because of this, CSU can acquire 100 companies that may total the same value as 1 PE acquisition and do that across industries, geographies, and scale at an increasingly accelerated pace as CSU’s crm of target companies grows. Now ask Vista if they will purchase a golf club software business for $10M. See what they say. This is CSU’s competitive advantage and why Leonard spends so much time studying other businesses, focusing on incentives, and tweaking the org design.

It’s a business I will continue to study for many years in order to learn about the structure that may benefit other startups and enterprises alike.

thanks Shomik! enjoyed this writeup a lot and also fascinated by CSU culture

Micro-targeting posts at me, eh?