Escape the Silicon Valley Filter Bubble

I’ve lived in a number of cities across the US (SF, LA, NYC, Chicago, Pittsburgh, NJ) and in the end the Bay Area is just a special place.

The natural beauty spread around everywhere, the moderate temperature that allows for year round outdoor activities, the focus on living healthy, and the dreamers thinking about impossible businesses to build and challenges to tackle.

And yet…sometimes we need to Escape the SV Filter Bubble in order to think clearly.

Building Companies

While the combination of the factors above makes the SV ecosystem the best place for founders to start and build ambitious businesses, it also leads to too much thesis creep.

Just take YC’s batch of startups. How many codegen, AI sales agents, foundational model for x, model eval companies have we seen. History rhymes and we saw the same thing with Web3 startups during the previous boom times, remote communication & hiring startups during covid, etc.

The SV Filter Bubble leads to magical things but also leads too many founders down the path of the mundane. If you’re going to build an AI sales agent, you better be damn sure that you have an opinionated take or tangible ROI improvement to separate from the rest of the pack who’s certainly going to build the low hanging fruit right behind you. Clay is one of the fastest growing startups at scale in the AI sales space…they’ve been assembling, cleaning, and organizing data for the past 7 years to get to this point. The proprietary and commodity data combined is what gives their product such a tangible ROI. However, most founders will just see “ooh a fast growing company” and go to build the same thing without understanding the end user workflows or amassing the data (and if the premise is the LLMs already have all the data….well then you truly don’t have an advantage at all since everyone else has access too including the “incumbent” you’re trying to disrupt).

Investing

The filter bubble also causes us to discount competition. Remember when Google released Gemini in March and people viewed them as a loser in AI. We saw Perplexity, OpenAI, and countless others proclaim the death of search and Google.

Now just 9 short months later, Google is back to leading in AI, is seeing rapidly growing search growth, and is starting to now test monetization on a whole new set of AI products across their billions of DAUs. The stock is up 47% over that timeframe for one of the largest and most followed companies in the world.

The “Death of SaaS” led Atlassian to trade at $40B, now at $65B just 5 months later, a 62% gain. If anyone had taken a pause to evaluate Atlassian’s competitive position, it was pretty easy to see that the easiest use of AI (enhanced search) would greatly increase the value of Jira & Confluence, Atlassian’s leading products, and thereby increase the server to cloud transition.

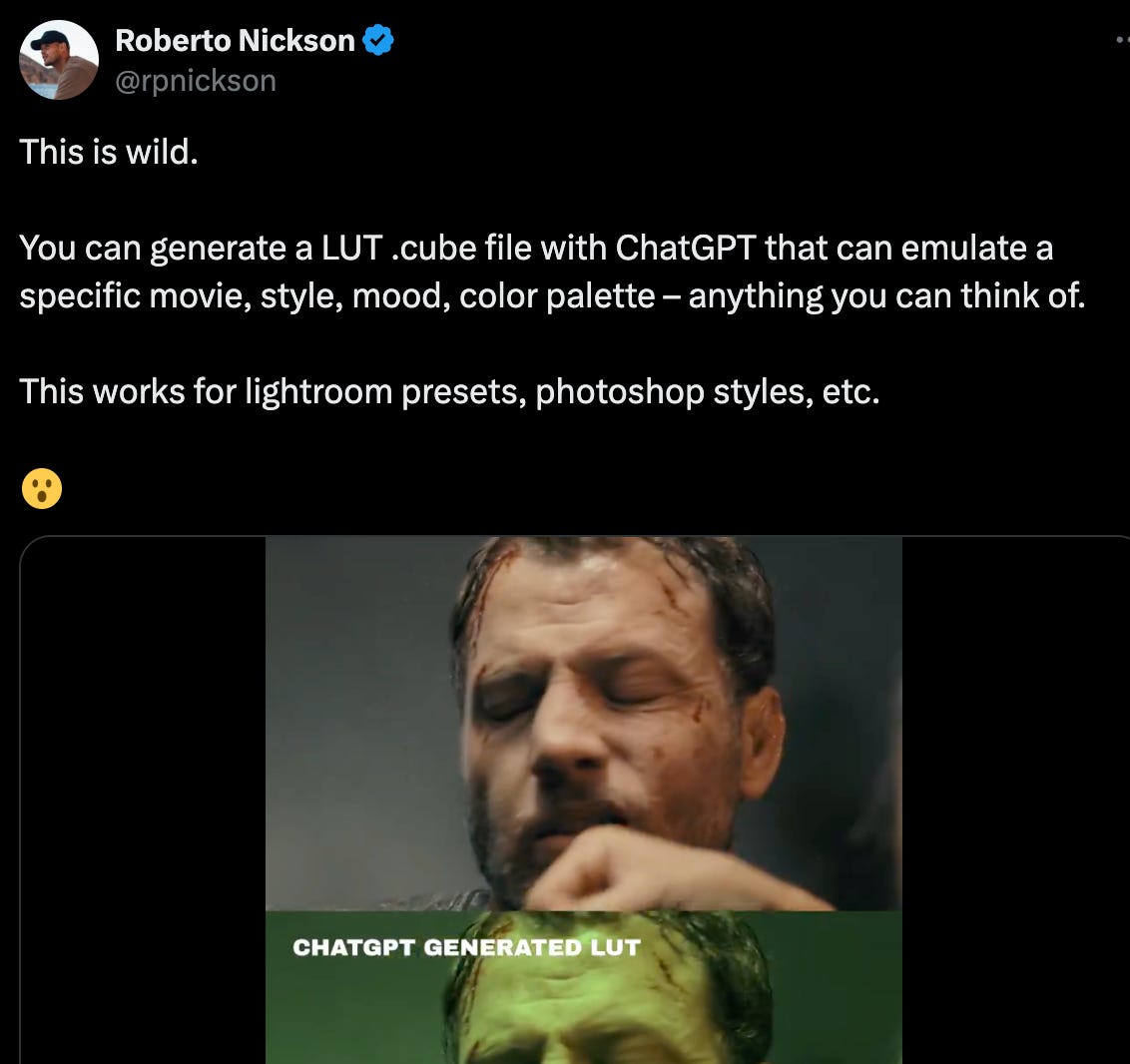

Now the same is happening with Adobe, its trading at 16x EBITDA and nearly a 3% free cash flow yield. SV is focused on OpenAI, Runway and others which will disrupt Adobe. The market is worried about Adobe being an AI loser. Meanwhile, creators are posting stuff like this using SOTA video models from OpenAI. Notice how the creator is using it to better improve the workflow he’s already working in (Adobe tools).

Dreaming Big on Hard Problems

The rush to experiment with new technologies is what makes the Bay Area both great and also challenging. Sometimes you need to pick your head up from the rush to see where you can apply the new technology in the biggest way.

The Noded AI team has huge ambitions but what they’ve started with is the primitive that modern AI unlocks a whole new way of classifying and organizing data to understand relationships and trigger workflows. The Waldo AI team has figured out how to do research in a specific sector that augments highly paid and time-strapped key employees. We’ve backed a robotics company and bio company both in stealth that are building world changing products leveraging foundational models that are highly scoped in their training and implementation.

All of them have at least 1 founder out of the Bay Area, allowing them to understand the latest in AI while also having a deep understanding of the domain and how to have an opinionated product to deliver a novel experience to users.

Look for Signals

Whenever you see a topic becoming too polarizing in SV, it’s a good idea to take a step back and play devil’s advocate. When everyone was posting about how OSS AI models were catching up, you could still see where the talent was flowing (OpenAI, Anthropic) and make an educated bet that proprietary models would lead with new form factors.

When codegen was the focus of all of tech twitter, companies like HeyGen and ElevenLabs were being started as some of the breakout apps of the GenAI revolution.

When Sequoia and Goldman published their pieces on AI’s $600B question, you could’ve bought Nvidia for a near 40% gain.

Right now as everyone is focused on the upcoming AI scaling wall…well you know what to do.