INFRA - Creating a Software Infrastructure Index

Investing in the Rails Powering Everything We Use Daily

Today I’m so excited to unveil the first Software Infrastructure Index to the world called INFRA from the folks at Thematic!

For the longest time, it has annoyed me that there is no way to simply track the performance of software infrastructure stocks nor invest in a basket of them easily through an ETF. The BVP Nasdaq Emerging Cloud Index is amazing however mixes together software infrastructure (dev tools, data infrastructure, cybersecurity) with vertical market software, application software, and more. The S&P Expanded Tech-Software Index includes gaming companies, semiconductors, and consumer software.

It’s crazy to me that there’s no way to invest solely in the software infrastructure that powers all of this innovation!

My good friend Jamin publishes this list of top 10 multiples in cloud software weekly and his newsletter is a must-read, subscribe here.

Notice anything? Out of the top 10 highest multiple software companies, 8 of the companies are software infrastructure. And yet, no index or ETF tracks these companies that the public markets are clearly excited about given the growth and free cash flow margins.

We all know the buzzwords, “Software is Eating the World”, “Data is the New Oil”, “AI is replacing jobs”, etc. However, what gets lost is none of these things can happen if mission critical infrastructure is not running behind the scenes, enabling all of this to happen! In order to make data into the new oil, you need a way to load, store, transform, visualize, and embed that data into other applications. If you don’t want that data in the hands of bad actors, you need cybersecurity to secure the applications properly. If you want new applications to be built faster, you need developers to have building blocks ready at their hands to create the products we use daily and love.

The other consistent truth is that Software Infrastructure is also more recession resistant compared to other areas of tech. Yes, cloud infrastructure spend will slow if people are purchasing less goods, but will companies entirely shut down their infrastructure? No because this is literally the way that the product is still up and running in order to sell goods and make money. By the way, this is not just relevant for digital products but also for physical ones. Target, Walmart, etc rely on software infrastructure daily to fire alerts on inventory issues, calculate pricing, send data automatically to suppliers, etc. These are not nice to have products but literally mission critical to running a business and generating revenue.

For that reason it is my belief that through capital cycles over the long term, infrastructure will outperform broader indices.

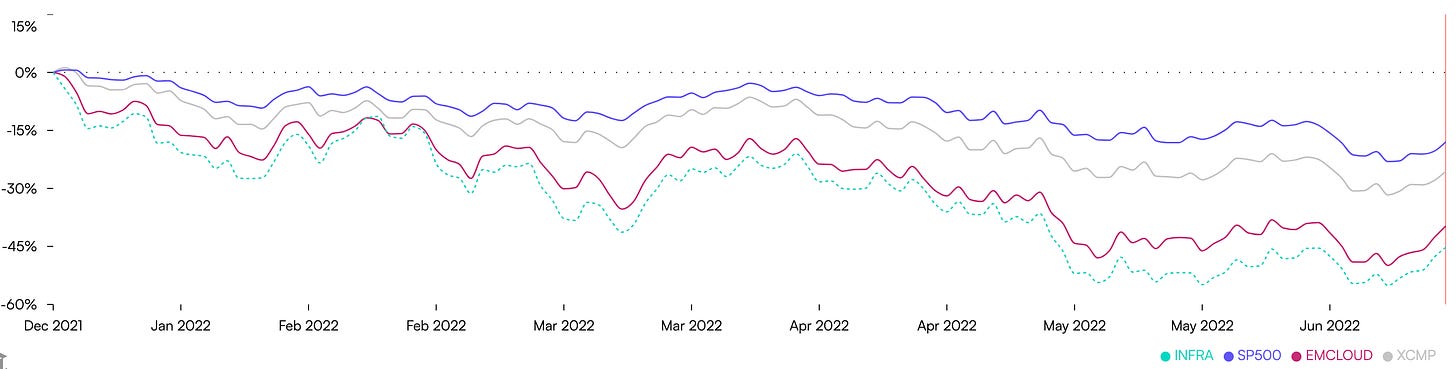

If you click on the INFRA index page powered by Thematic, you can see the above chart showing relative performance over the past 6 months. The infrastructure index has so far underperformed the S&P 500, Nasdaq and Wisdomtree Cloud ETFs. This is a result of the infrastructure companies all trading at the highest multiples previously so when contraction hit, it hit them the hardest. That being said, 8 of the top 10 highest multiple software companies are still infra companies which shows that these companies will continue to maintain premium multiples to the market.

I will update the performance of this index on a 6-month basis to see how it goes. My hope is one day, to be able to turn this into an ETF and that over a 3, 5 and 10-year basis, the INFRA index will outperform the other 3 benchmark indices listed.