Recently, payments API company Marqeta filed for an IPO. The company reported staggering YoY growth of 123% for its most recent quarter. $108M of revenue in one quarter growing that fast is no joke! However, as investors looked under the hood, horror struck. For that same quarter, one customer Square generated 73% of revenue or ~$79M of the $108M in the quarter!

The common rhetoric is that customer concentration is bad and diversification is good. This is usually similar in investing although nowadays with the recent bull market a lot more folks have been leaning more towards concentration than diversification. And yet, when a company does so….everyone freaks out.

What does customer concentration really mean? Everyone understands the bad side (tying the company’s fate to one customer) but what’s the good side?

In venture investing and startups, power laws are one of the most understood concepts. If you got into Coinbase’s seed round, for that fund it frankly doesn’t matter what other companies you got into as well since Coinbase’s value would drastically dwarf all else. For that employee, all their other net worth up to that point likely doesn’t really matter, as Coinbase equity likely dwarfs that. Most of venture investing is structured to create more of this power law effect. Once you have a Coinbase, you want to invest as much as possible to drive the most returns.

I apply this same concept to customer concentration. On the surface, yeah 73% of revenue coming from one customer seems like a huge risk. On the other hand, if they continue to add tons of value to Square and Square continues to outperform, then Marqeta has caught a tiger by the tail and will continue to have amazing growth for a long period of time.

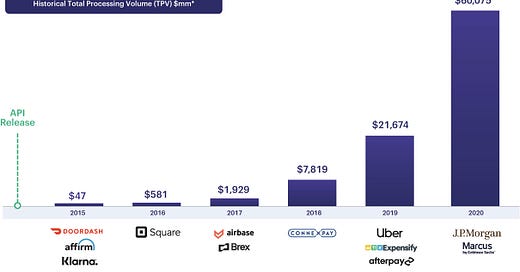

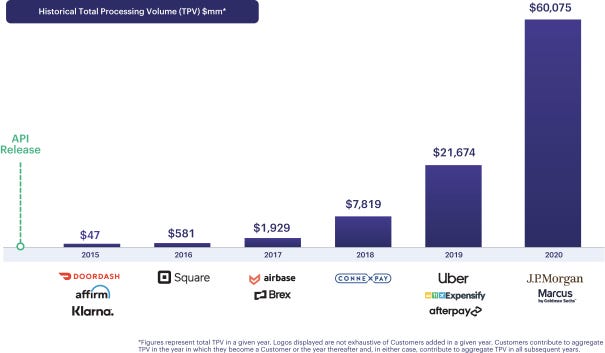

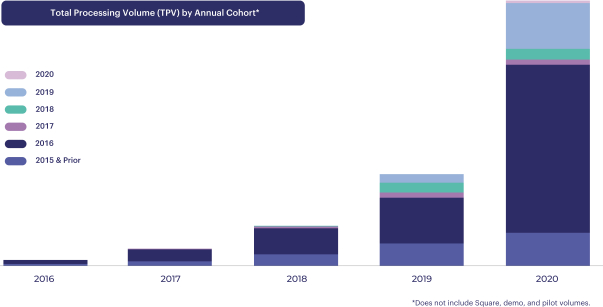

Customer concentration also disguises a lot of nuance. It’s point in time and very high level. When looking at the above chart, Square was landed as a customer in 2016. Uber was landed in 2019 and JP Morgan and Goldman’s Marcus in 2020. Now Square likely does have a power law effect in the portfolio, but does no one think that Uber or literally the biggest bank in the world in JP Morgan can have similar success when fully ramped?

Also, Square started as a Marqeta customer on the merchant side. Then they chose to use Marqeta’s solution again for the Cash App card. While that is one company, it is most definitely two different customers with different stakeholders, needs, and end user experiences. What if of the 73% of revenue from Square, 80% of that is the merchant biz and Cash App is only 20%? If so, could Square customer concentration get even worse and is that a bad thing? We don’t know the maturity of Square’s various businesses using Marqeta nor what future businesses they may choose to launch using Marqeta again!

I think this cohort chart will look very different with 2019 likely equal to the 2016 cohort in the future and 2020 likely the same as well at some point down the road.

Many of us forget, but Twilio also had high customer concentration (although not as high) at the time of their IPO. In fact, it only got worse as WhatsApp and Uber continued to scale becoming a bigger part of Twilio’s revenue. Jeff Lawson has spoken about how Twilio did not have sales or customer success monitoring the success of Uber so even as it became a massive customer, Twilio was treating them just like any other. The downgraded usage or churn from Uber likely could’ve been managed better. I’m sure Marqeta has learned from that lesson. Meanwhile, Twilio is up 10x in 4 years.

Just like everything else, we need to dig below the surface to understand more. We’ll see how much Marqeta discloses in the future to help with this. However, it is not necessarily a bad thing if there’s high customer concentration.

Sometimes, it is just the power law in effect.